distinguez-vous !

ENTREZ SEREINEMENT DANS LE MONDE DE L’ART GRÂCE À MUSY ART.

Décodez le marché de l’art et ses tendances, découvrez ses artistes et acquérez une œuvre qui vous ressemble ! Chloé et Ayoko accompagnent chacun de vos pas dans le marché de l’art.

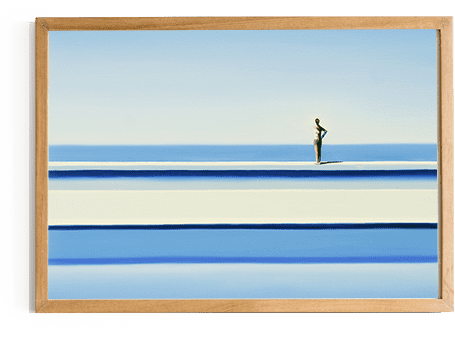

Acquérir

une œuvre d'art

Choisir de faire l’acquisition d’une œuvre d’art est à la fois un choix de raison et de passion. Après étude de votre situation, Musy Art vous propose des préconisations en accord avec votre démarche, associée à des projets artistiques qui vous font vibrer !

FAITES UNE ENTRÉE SEREINE

DANS LE MONDE DE L’ART

GRÂCE À LEURS PARCOURS ÉCLECTIQUES ET COMPLÉMENTAIRES, AYOKO ET CHLOÉ, VOUS INITIENT AU MARCHÉ DE L’ART POUR AIGUISER VOTRE SENS ARTISTIQUE, APPRENDRE À VOUS POSITIONNER SUR LES TENDANCES DE DEMAIN.

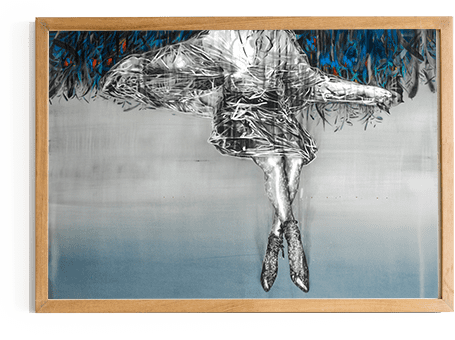

AIGUISEZ

VOTRE REGARD

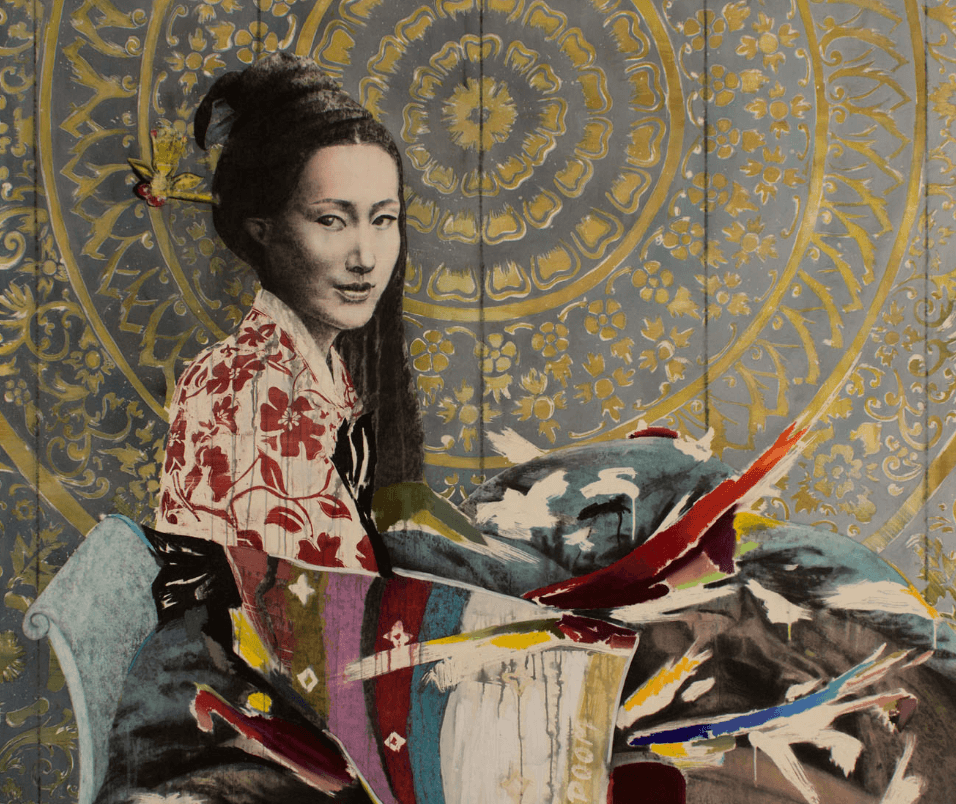

QUAND L’ART S’INVITE

EN ENTREPRISE !

MUSY ART, L’APPROCHE MODERNE

DU CONSEIL SUR LE MARCHÉ DE L’ART

Musy Art, c’est avant tout une histoire d’expériences et de rencontres ! Ayoko et Chloé, les fondatrices, décryptent les tendances du marché, échangent avec les artistes qui feront l’histoire de l’art de demain, et vous offrent une expérience unique pour atteindre vos objectifs, en immersion totale dans le monde de l’art.